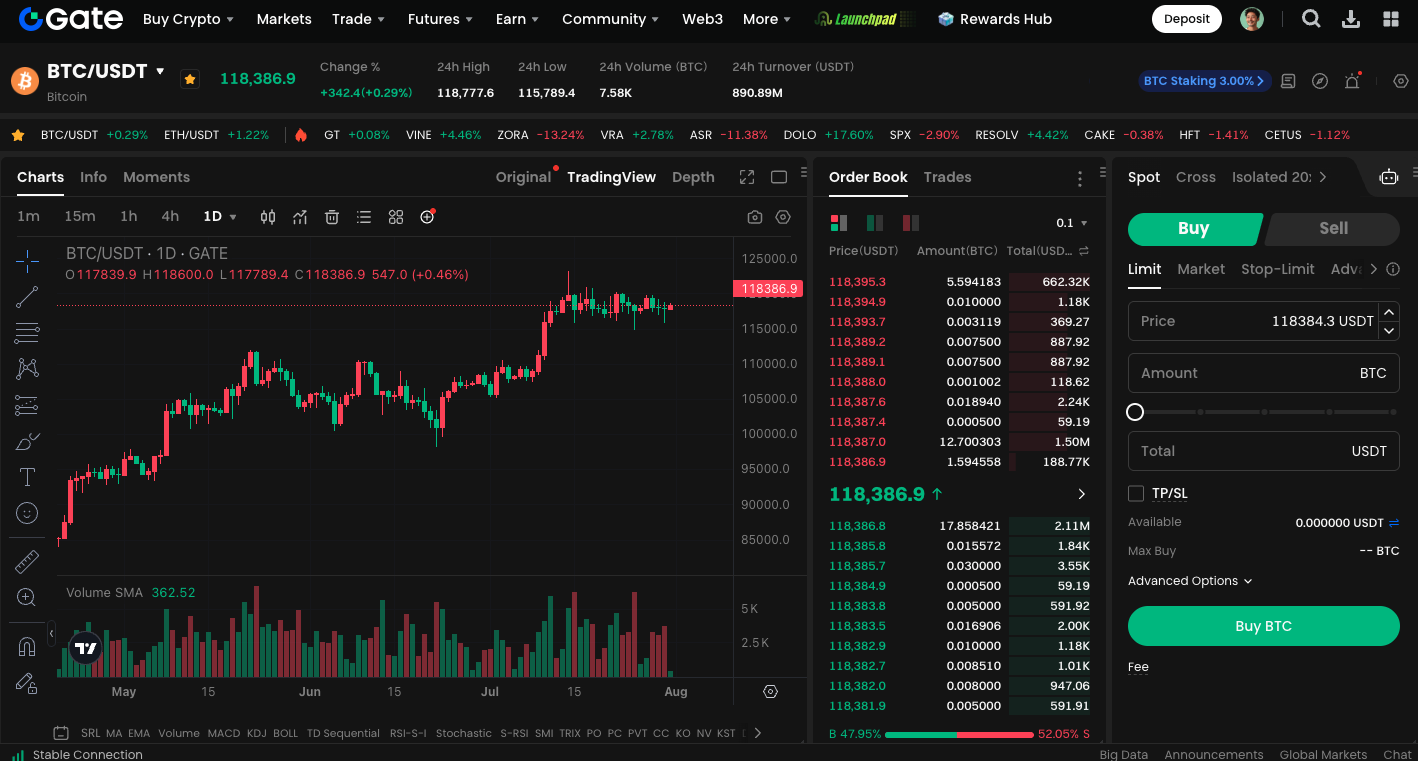

Bitcoin Price Prediction: Bitcoin Maintains Key Support at $118,000, Setting the Stage for a Potential 10% Short-Term Rebound

Bitcoin Shows Resilience Amid Downturn

Despite the Federal Reserve's decision to keep its benchmark rate unchanged at 4.25% - 4.5% during its latest meeting, markets remained relatively calm. Chairman Jerome Powell adopted a wait-and-see approach, offering no clear indication regarding a possible rate cut in September. This has further delayed the timeline that markets had anticipated for rate reductions. Nevertheless, Bitcoin held firm above the $118,000 support level, demonstrating a robust bottom structure and leaving room for potential rebounds.

Expectations for Rate Cuts Cool Off

Powell indicated that any decision on a September rate cut would depend on upcoming economic data and stressed that no decisions have been made. Market participants lowered the odds of a September rate cut from 63% to 40% after the meeting. Even so, most market participants still expect one or two rate cuts before year-end. Nick Ruck of LVRG Research noted that the Fed's more cautious stance could slow the bull market's pace, but overall liquidity should continue to provide downside support for the crypto market.

Crypto Assets Continue to Consolidate

While recent policy decisions have not offered immediate bullish catalysts, after briefly dipping following the news, BTC quickly rebounded during early Asian trading hours and stabilized around $118,300. The total market capitalization has traded sideways for the past two weeks, signaling persistent caution among investors. Ethereum (ETH) has likewise stayed relatively strong, currently trading above $3,800 despite broader macroeconomic uncertainties.

BTC Eyes Move Toward $130,000

From a technical standpoint, if BTC can maintain support above $118,000 and break firmly through the $120,000 mark, the next rally could target the $128,000 - $130,000 range. This implies an upside potential of about 8 to 10%.

Funds Rotate to Defensive Positions

Although the Fed's inaction has created short-term uncertainty, institutional investors are not pulling out in significant numbers. With returns weakening in traditional markets, some capital continues to flow into crypto assets as a hedge. In particular, ahead of a new round of U.S. tariffs set for August 1, increased safe-haven demand may further support BTC price action.

If BTC falls below $115,000, it could test lower support levels, but current trading volume and buy-side activity suggest a downside break is unlikely in the short term.

Start trading BTC now: https://www.gate.com/trade/BTC_USDT

Summary

With interest rate hikes on hold, uncertain economic data, and growing geopolitical risks, BTC is showing strong support. As long as it holds above $118,000, Bitcoin has room to challenge $130,000. In the coming weeks, changes in macroeconomic data and market sentiment will be key drivers.